Advertisements

LAPO loan app is one of the numerous loan apps people visit when they have an urgent financial need to sort out. LAPO Microfinance Bank owns the LAPO loan app and aims to provide flexible loan plans for individuals and organizations with little interest and no collateral.

Although the company has over 500 branches scattered all over the country where you can walk into and get loans, you can easily access loans through their USSD code, website, or app available on Google Play Store or iOS App Store.

LAPO has grown to give out loans to over 3 million users since its establishment making it one of the biggest loan companies in Nigeria. This microfinance bank not only gives out loans but also provides saving services, but this article focuses on loans.

Introduction and History of LAPO Loans

LAPO is an acronym for Lift Above Poverty, and the company has been living up to its name since it was established in 2007 by Dr. Godwin Ehigiamusoe. Initially, LAPO started as a nongovernmental organization in 1987 till it expanded and changed to a microfinance institution in 1990; by 2007, it was registered as a microfinance bank.

Advertisements

After the company became a licensed microfinance bank in 2012, it became successful and expanded its branches in over 26 states in Nigeria. Currently, LAPO is rated as one of the best microfinance institutions in the country and has won the Microfinance Bank of the Year under the Businessday Bank and Other Financial Institutions award.

With LAPO loans, you can get unsecured loans ranging from N30 thousand to N5 million, depending on the type of loan you are applying for.

How Can You Access the LAPO Loan Platform?

There are three ways customers can access the LAPO loan products and services. The first is to visit any of their physical offices in any state in Nigeria. You can get directions to the nearest office by visiting any map product on your phone, like Google Map; type in “LAPO Microfinance Bank,” and you will get instant directions.

The company has an active website where you can apply for loans, read more information about it, or contact their customer service team without going through the stress of visiting the physical offices. The website for accessing loans is https://www.lapo-nigeria.org/loans.

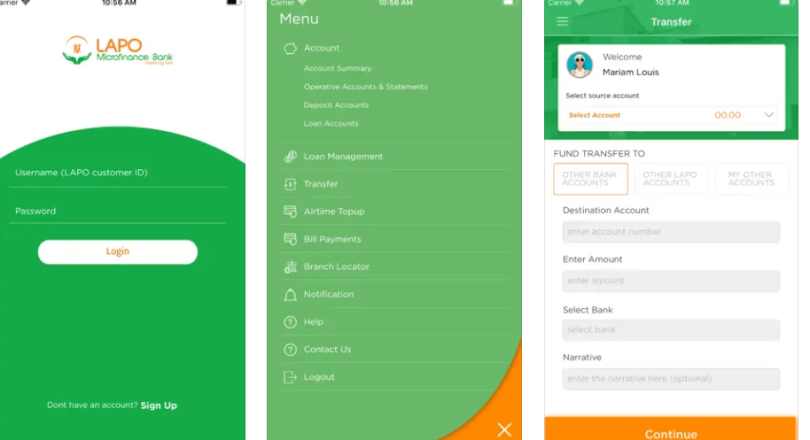

The LAPO loan app is available on Google Play and iOS App Store. If you use an Android device, visit your Google Play Store, but if your device is an iOS, you can search for the app and download and install it.

For those who do not have a smartphone, you can enjoy LAPO products using their USSD code.

What is LAPO Loan USSD Code?

LAPO USSD code is for customers who want to obtain loans from the company while sitting in their comfort zones; any phone can use the code for transactions. The code makes it easier to borrow money if you do not have a smartphone or wish to use the other options.

The LAPO USSD code is *371#, but this comes with a service charge of N6, and you can only access loans up to N350 thousand. To use the USSD code:

- Dial *371# on your phone and wait for the prompt message.

- Input your BVN and follow other instructions that will come later. The instructions and messages depend on the service you will be accessing.

If the LAPO Microfinance bank approves your loan request, it will credit your account.

LAPO Loan Branches and Offices

LAPO Loans has many branches in Nigeria, with its head office at 18 Dawson Road, Benin City, Edo State; the company’s annex head office is at Irorun Plaza, 2nd Floor, Kudirat Abiola Way, Oregun, Ikeja, Lagos State.

There are 535 branches of LAPO Microfinance Bank in 34 states out of the 36 total states in Nigeria, including the Federal Capital Territory, Abuja. Some states with higher populations have more than 50 branches, making it easier for customers to access the offices and get proper attention.

Benefits of LAPO Loans

There are some benefits LAPO Loans have that customers get to enjoy when they use any of their loan products and services; these benefits include:

- There is no collateral for any loan type and request, and clients do not have to commit their properties just like traditional banks require.

- There is a flexible repayment plan.

- The company offers customers financial advice and basic financial management strategies when needed.

- Business owners can quickly get access to funds to expand their businesses.

- There is a low-interest rate as compared to other loan companies and apps.

Disadvantages of the LAPO Loans

LAPO loan has some drawbacks or disadvantages, and they are:

- Customers must present guarantors before the company can approve their loans.

- All loan types have a maximum of one year; this means you have until the end of a year to repay your loans.

- There is a limit to individual loans; the company operates more on group liability. This means customers must belong to a union to access most loan types.

Types of LAPO Loans

Lapo Microfinance Bank has 8 types of loans suitable and available for different customers; these products include:

SME Loan

This is specifically for small and medium-scale enterprises and businesses in Nigeria. The loan aims to provide business owners with the capital or credit facility they need to expand their businesses without asking for collateral. With this loan, individuals can get up to N5 million and an affordable interest rate; the time frame is 12 months, so there is enough time to repay the loan.

Features of the SME loan

- Accessible to individuals

- Credit facility up to the amount of N5 million

- The repayment plan lasts for 12 months

Benefits of the SME loan

- Accessible business and financial management training

- No collateral

- Access to funds for business

- The flexible time frame for repayment

Requirements for SME loan

- 2 guarantors

- Valid means of identification like an international passport, driver’s license, national ID, or voter’s card.

- A completed application form

- Loan application letter

- 4 recent passport photographs

- Recent utility bill receipt

Agricultural Loan

Like the name, this loan is for agriculturalists wishing to expand their farms and get better results. This product aims to help agriculture, one of the socioeconomic sectors of any nation. Farmers can get loans ranging from N50 thousand to N500 thousand.

Features of the Agricultural Loan

- A minimum of N50 thousand and a maximum of N500 thousand.

- Anyone, like individuals, groups, and corporate organizations, can access this loan, but they must have active and existing farm investments.

- Loan duration is between a month to 12 months with a grace period of 30 to 60 days.

Benefits of the Agricultural Loan

- No collateral and low-interest rate

- Available capital for farms

- Flexible repayment plan

- There are experts available to give financial advice to clients.

Requirements

- A valid means of identification

- 2 guarantors

- Recent utility bill receipt

- Duly filled application form

- 2 recent passport photographs

Education Loan

Education loan is aimed at helping parents and students sort out education expenses; school owners can also apply for this loan to improve their school’s educational facilities; only individuals who are union members can request this loan. This product comes in two categories: school fees and improvement loans.

The school fees loan can only be used to sort out school fees, levies, books, uniforms, and school transportation with an interest rate of 4%. The minimum amount is N20 thousand, while the maximum is N200 thousand. Clients only have one month to repay the loan.

On the other hand, the school improvement loan is for private school owners who wish to improve their school standards and facilities. Clients can get from N250 thousand to N500 thousand with an interest rate of 4%; however, they must repay in 3 to 18 months or each academic term.

Features of Education Loan

- The loan amount ranges from N20 thousand to N500 thousand.

- Only clients under a union can access this loan.

- Loan duration is 1 to 18 months with a grace period of 1 month.

Benefits of the Educational Loan

- Zero collateral

- Low-interest rate

- Access to funds for school fees and educational facilities

- The flexible time frame for repayment

Requirements

- Loan application letter

- A valid means of identification

- 2 guarantors

- 4 recent passport photographs

- Completed application form

- Current utility bill receipt

Asset Loan

Asset loan is only for existing customers of the microfinance bank to help them buy equipment like refrigerators, generating sets, transport vehicles, and many more that will further help their businesses to grow. You can get from N20 thousand to N400 thousand and repay within 11 months.

Features of the Asset Loan

- The loan amount ranges from N20 thousand to N400 thousand.

- The repayment is 11 months, with a grace period of 1 month.

- Both individuals and groups can access the loan.

Benefits of Access Loan

- No collateral and zero interest rate

- Access to funds for business equipment

- Flexible repayment time frame

- Experts give out financial advice to clients

Required documents for the Access Loan

- A savings account with Lapo Microfinance Bank

- A valid means of identification

- 2 guarantors

- Duly filled application form

- Recent utility bill receipt

- 2 recent passport photographs

Public Sector or Salary Loan

LAPO Microfinance Bank gives out personal loans to salary earners through Payroll Lending to Civil Servants; salary earners at the state and federal levels can access the loan. LAPO Microfinance Bank uses Salary Access Deduction Code to deduct a percentage of the customer’s salary at the end of each month, even before the money gets to the personal account.

Customers can get up to N20 thousand to N3 million and repay within 1 to 12 months.

Features of the Salary Loan

- Individuals can access this loan.

- The loan amount ranges from N20 thousand to N3 million.

- The duration time frame is between 1 to 12 months.

- The customer must be a civil servant under the state or federal government.

- There is no need for a guarantor.

Benefits of the Salary Loan

- Clients do not need to have an account with the microfinance bank

- The loan gets approved in 6 hours

- Zero collateral and a low-interest rate of 2.95%

- Flexible repayment plan

- Clients get training in financial management and business planning.

Requirements for this Loan

- Completed application form

- 2 recent passport photographs

- A valid means of identification

- Last three months’ bank statement

- Clients must have two years left to serve as civil servants.

- Last three months’ pay slip

Regular Loan

The Regular Loan is for people in a union who need money to run their small businesses. The clients in each group can access individual loans but have guarantees as a group.

Features of the Regular Loan

- Clients can access loans ranging from N30 thousand to N150 thousand and pay them back in 8 months.

- There is a grace period of 2 weeks.

- Clients are to pay in some part of the loan every week.

- There are charitable trusts for clients.

- Individuals get access to loans under the union.

Benefits of the Regular Loan

- Zero collateral and low-interest rate

- Clients have access to loans for their small businesses.

- Through regular loans, you can get access to asset loans.

- Flexible repayment plan

- Expert financial advice and business training.

Requirements

- Duly filled application form

- 2 recent passport photographs

- Current electricity bill

- 2 guarantors

- A valid means of identification

Special Loan

The LAPO Special Loan is only for existing customers needing a bigger loan to improve their businesses. Only clients who are in a union can get money from this loan type, and the repayment frequency is every month.

Features of the Special Loan

- Loan amount of N50 thousand to N250 thousand.

- Clients must be a member of a union.

- The loan lasts 6 months and a grace period of 1 month.

Benefits of the Special Loan

- Low-interest rate and zero collateral

- Clients get higher amounts of loans for their businesses.

- Flexible repayment schedule

- Expert financial advice and business training for clients.

Required documents for the loan

- Excellent regular loan repayment history

- 2 guarantors

- 2 recent passport photographs

- Current utility bill receipt

- A valid means of identification

- A completed application form

SUFEN Loan (Supporting Female Entrepreneurs)

This loan is a special product for female entrepreneurs who want to expand and improve their businesses. There is a flexible repayment time frame, and the requirements are the same as other regular loans.

Basic Requirements For LAPO Loans

The requirements or documents customers will submit to get LAPO loans depend on the type. However, the basic requirements are:

- Duly completed application form

- You must be 18 years and above

- Customers must be citizens of Nigeria

- An active bank account with any Nigerian bank.

- Good credit history

- 2 to 4 passport photographs

- Loan application letter

- 2 guarantors

- Current utility bills

- A valid means of identification like a driver’s license, a national ID, an international passport, and a voter’s card.

How To Apply For LAPO Loans

If you wish to visit any of the LAPO branches and apply for a loan, follow the step below:

- Locate the nearest office to you

- Request for an application form and provide accurate information.

- Submit the form with all required documents and wait for approval.

You can also get loans from Lapo Microfinance Bank but only the SME loan and the LAPO Public Service Loan or Salary loan. Visit their website, open the app, or dial the USSD code. Follow the instructions, provide all information, and submit the required documents. Wait for a few minutes or hours to get the money.

How to Get Approval for LAPO Loans

Getting approval from the LAPO Microfinance Bank for any of the loan types is very easy. To get quick approval for your loan, you should submit all the required documents, meet all criteria and ensure the amount you are applying for is within the loan type your application is categorized under.

Most people get approval for their loan requests only if they have a good credit history. Bad credit history is common with people who do not repay loans from microfinance banks or loan companies within the specified time.

What is the LAPO Loan Interest Rate?

LAPO Microfinance Bank’s flexible interest rate makes it easier for customers to repay their loans easily.

The interest rate depends on the amount Lapo Microfinance Bank is giving out. However, the monthly interest rate is between 0.75% to 6%, which is low compared to other loan companies.

Is There a LAPO Loan Calculator?

LAPO Microfinance Bank does not have a calculator on their website that allows customers to calculate how much interest their loan comes with. However, with a simple calculator, you can find out how much to pay as interest.

Since each loan type comes with a particular interest, you can easily calculate the interest on your own.

What is LAPO Microfinance Bank Revenue?

LAPO Microfinance Bank is estimated to have an annual revenue of $82.6 million to $109.9 million.

Like other microfinance banks, LAPO Microfinance Bank makes its money through fees and commissions they get when it renders services like management of accounts, processing, and transferring funds for clients. Most of the revenue the LAPO Microfinance Bank gets us from interest; this makes up 70% of their income.

Frequently Asked Questions

Can I borrow from Lapo online?

You can get loans from LAPO Loans online; they have available means like their app, website, and USSD code. The website and app have no service charge, but the USSD code comes with an N6 charge.

How much can I borrow from LAPO for the first time?

As a first-time user or customer, you can borrow up to N500 thousand from LAPO Loans, although this amount depends on the type of loan you are applying for. Some loan types have lesser amounts as their maximum amount.

Does LAPO need collateral?

Lapo Loans do not need collateral to give out loans to customers. Anybody that requests money or collateral before giving you a loan is not a genuine LAPO agent.

Does LAPO give loans to salary earners?

LAPO Loans give out loans to salary earners. The Public Sector or Salary Loan type is specifically for state and federal-level civil servants, even if they do not have an account with the microfinance bank.

Bottom Line

LAPO Loan is one of Nigeria’s microfinance banks to provide money to help people sort out their financial needs and repay within the specified time. There is no need for collateral, and the interest rate is low compared to other loan companies. This article has detailed information about LAPO Loans and how to get loans from them easily.

Advertisements