Advertisements

Migo Loans is a cloud-based company that gives out easy loans to clients without collateral or a guarantor. The process of getting loans from this company is fast and easy due to the partnership it has with different banks, fintech companies, telecommunication industries, and merchants to make financial transactions and loans very accessible.

Clients who apply for loans from Migo get results in a few minutes, and they only have to dial the company’s USSD code or visit the website. You can get loan amounts ranging from N500 and N500,000 within a few minutes.

This article will provide detailed information about Migo Loan and how to get approval for your loan request.

Overview of Migo Loan

Formerly known as Kwikmoney or Kwikcash, Migo Loan was founded by Kunle Olukotun and Ekechi Nwokah in 2014 to help institutions in the market offer credit products to their customers without the compulsory use of smartphones; this means anyone can access this product.

Advertisements

Migo Loan works by integrating its product into the partner’s app, thereby covering or overthrowing the clients while providing them with a digital account and a credit line; they use the credit line for transactions and to access loans.

The company has its headquarters in San Francisco, California, USA, but is currently based in Ikoyi, Lagos, Nigeria. Since its establishment, Migo Loan has over 1 million customers and partners with brands like 9mobile, Airtel, NIBSS, and BuyPower.ng, Flutterwave, Fidelity Bank, Access Bank, Zenith Bank, and many more.

Migo Loan is available in countries like Nigeria, Brazil, and the United States.

How Can You Access the Migo Loan?

Clients can only use the Migo Loan products by visiting the company’s official website – https://www.migo.ng/ or dialing any of their USSD codes depending on the service they want; however, the generic USSD code is *561#.

As of the time this article is published, Migo Loan does not have any app on both Google Play Store and iOS App Store.

What is Migo Loan USSD Code?

Migo Loan has a general USSD code – *561#; this has all the Migo Loan service clients may want to use.

Clients who want to avoid many screen selections and save time can use the USSD menu shortcuts like:

- *561*1*1*1# – To take out a loan

- *561*1*2# – To repay a loan

- *561*1*3# – To check loan balance

- *561*1*4# – To extend your loan

- *561*1*5# – For terms and conditions

- *561*1*6# – To recommend a friend to Migo

Migo Loan Branches and Offices

Migo Loan only has a branch office in Nigeria, and the address is at 3b, Adekunle Lawal Rd, Ikoyi 100001, Lagos, Nigeria.

The headquarter office address is 95 3rd St, San Francisco, California, 94103, United States.

You can visit any of these offices or conduct transactions via the website or the USSD code.

How to Contact Migo Loans Customer Support

Migo Loan has an effective customer support team that is available 24/7 to offer help to clients and answer all questions. You can reach out to them via their:

- Phone Number: +234 (0) 1 700 2274 and +2349087792933

- WhatsApp Number: +2349087792933

- Email: [email protected]

- Facebook: https://m.facebook.com/getmigomoneyng/

- Website: https://www.migo.ng/consumer/customer-support

- Twitter: https://mobile.twitter.com/getmigomoneyng

- Instagram: https://www.instagram.com/getmigomoneyng/

- Linkedin: https://www.linkedin.com/company/migomoney

- Youtube: https://youtube.com/@migo7171

Benefits of Migo Loan

Migo Loan has many benefits its clients will enjoy when they use any of the Migo Loan services; these benefits include:

- Clients will enjoy a low and competitive interest rate compared to other loan companies.

- The loan application process is straightforward.

- Clients must not submit any collateral or a guarantor to access any loan.

- There is a flexible time frame to repay loans, and customers have between 30 to 365 days to repay the loan, although the time frame depends on the loan amount.

- Migo Loan can approve your loan request in seconds, while you get the money within a few minutes.

- An excellent customer support team is available to help customers and answer questions about any product or service.

Disadvantages of Migo Loan

Although Migo Loan is one of the best loan companies in Nigeria, there are some drawbacks or disadvantages the company has:

- First-time users have a limited amount of money they can get as loans.

- The interest rate for some products is higher than others.

Types of Migo Loan

Migo Loan has two types of loan services for customers, and they are:

Personal Loan

This type of loan package is available for individuals who need money to sort out their financial expenses like medical bills, house rent and repairs, educational expenses, and other emergencies.

Business Loan

As the name suggests, this type of loan is strictly for new entrepreneurs and existing business owners who need funds to start or grow their businesses. The loan can be used to buy business facilities and equipment, pay for space, or renovate infrastructures.

Each of these types of loans has amounts ranging from N500 to N500,000, although new customers can only borrow up to N50,000. The faster you pay off outstanding loans, the more you can borrow from the company next time. Note that both types of loans have the same benefits and requirements.

Basic Requirements For Migo Loan

Before you can get any loan amount from Migo Loan, there are some basic requirements you must have, and they include:

- A bank account that has been active for over three months.

- You must be up to the age of 18 years and above.

- A working phone number

- The phone number must have been used actively for the last 90 days.

- Bank Verification Number (BVN)

Before applying for any Migo Loan, be sure that you have an active account with any of the following banks:

- United Bank For Africa (UBA)

- Access Bank

- First City Monument Bank (FCMB)

- Zenith Bank

- Heritage Bank

- Wema Bank

- First Bank of Nigeria

- Polaris Bank

- Union Bank

- Guaranty Trust Bank (GTB)

- Stanbic IBTC Bank

- Fidelity Bank

- Unity Bank

How to Apply For Migo Loan

There are two ways of applying for a loan from Migo Loan and you can use the website or dial the USSD code.

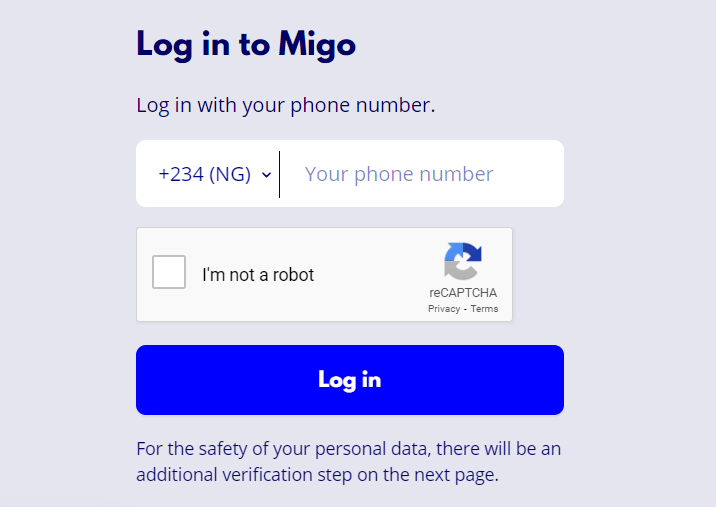

To use the website for loan application:

- Visit the company’s website – https://www.migo.ng/ and click the “Get A Loan” tab.

- Input your phone number and verify you are a human by completing a captcha.

- The company will send a confirmation code to the phone number you gave out, type in the code to verify your phone number.

- Click on “Check Loan Offer,” and you will see a list of loan offers available.

- Click proceed, and type in your account number and other information.

- You will get your loan in a few minutes.

If you wish to get a loan using the USSD code:

- Dial *561# on your phone and select “Loans.”

- Click on “Request Loan” from the many options you will see.

- You will receive a loan offer, accept the offer, and type in your account details.

- You will get your loan in a few minutes.

How to Get Approval for Migo Loan

Getting approval for your loan request is effortless if all the details you input are accurate. Also, ensure the amount you want or request is within the range available.

Migo Loan may reject your loan application if there is an increase in demand for loans; that is, if the company exhausts its target or has more customers than it can handle, it may reject some loan applications.

Some people may not get approval for their loan requests if they have a bad credit history; this is one disadvantage of refusing to pay for loans from other loan companies or microfinance banks, you will get a bad credit history.

How to Repay Your Loan

There are some ways you can repay money you borrowed from Migo Loan, and they are through:

Bank Transfer

Follow the steps below:

- Go to the loan repayment website – https://www.migo.ng/consumer/repay-a-loan

- Enter your phone number and click on “Pay My Loan.”

- Select “Bank Transfer” from the numerous payment options available.

- Click on your bank

- Click on the tab to continue the process

- You will get a code to dial

- Select the bank name to which you will be transferring money and wait for the payment to be completed.

Online or on the Websites

You can process the payment on the website without selecting any bank; you only need your bank card. Follow these steps:

- Visit the website – https://www.migo.ng/consumer/repay-a-loan

- Enter your phone number and Select “Pay Loan.”

- Click on the “Pay with card” option from the many payment options you will see.

- Select the card if you have saved your card details on the website. If you have not saved any cards, click on “add card” and follow the instructions to save your card.

- Confirm the payment, and you will get a confirmation message within seconds.

Quickteller ATM

You can only pay using a Quickteller ATM; make sure you have a phone that receives your bank alerts. This payment option has a service charge of N100. Follow the steps below to pay for your loan using an ATM:

- Insert your ATM card and click on “Quickteller.”

- Select “Pay Bills”

- Click on “Others”

- Type in “04354101” as the payment Biller Code.

- Type in the phone number you used for Migo registration as the “Customer Reference Number”

- Confirm the payment, and you will get a confirmation message.

USSD Code

To pay using the USSD code:

- Dial *561# with your mobile phone and select “Loans.”

- Select “Pay Loan”

- Select the “Pay with phone” option from your payment options list.

- Select the “Card Card” option and follow the instructions to register your card.

- Confirm the payment and wait for a confirmation message.

Cash

You can also pay for your loan through cash, but you must visit banks like Wema Bank, Fidelity Bank, Keystone Bank, Access Bank, GT Bank, Sterling Bank, and United Bank of Africa (UBA).

Inform any of the bank staff you wish to make a payment to Migo Loan using PAYDIRECT; you do not need to have an account with any of the banks. The phone number you used for the loan request will also be used as Customer Reference Number for the Paydirect option.

What are the Interest Rates For Migo Loan?

Migo Loan has a flexible and low-interest rate that ranges from 5%- to 25%. The interest rate is not fixed; it depends on your credit history and the amount you are requesting for.

The interest rate can also increase if you do not pay back the loan within the specified time. However, you can extend the payment time by dialing *561*1*4#; you can also visit the website, select “Loans,” and click “Extend Loan.” After you have paid 20% of the loan amount, Migo Loan can extend the time to 30 days.

Is There a Migo Loan Calculator?

Migo Loan does not have an interest calculator on their website that allows customers to calculate the amount they will pay back. However, with a simple calculator, you can find the interest rate and how much it reflects on the repayment amount.

When applying for a loan, Migo Loan will show you the interest rate your offer comes with, and you can easily calculate the interest on your own.

What is Migo Loan Revenue?

Migo Loan is a successful loan company judging by its annual revenue. As of 2019, Migo Loan is estimated to have an annual revenue of $5 million to $10 million; as of 2022, the yearly revenue is slightly above $15.7 million.

The company makes its money through the interest from over 1 million customers in Nigeria, Brazil, and the United States.

Frequently Asked Questions

What will happen if I don’t pay my Migo Loan?

If you wish to get more loans from Migo Loan or increase your loan limit, you must repay the loan when the time is due. If you do not pay your loan as of when due, you will get a 5% additional default fee.

If you still do not repay even after the additional default fee, the company can issue further penalties like sending a reminder to your contacts. Note that these penalties are all in the terms and conditions you signed.

Is the Migo Loan registered with CBN?

Migo Loan is registered with the Central Bank of Nigeria (CBN), although the federal bank does not directly regulate the activities of the loan company. However, Migo Loan fully complies with all the regulations the CBN gives. The Central Bank of Nigeria also regulates the relationship between Migo Loan and its partners.

Can I pay a part payment on the Migo Loan?

It is possible to pay part of the loan amount you owe. To do this, you have to visit the website and choose a payment option. Click on the payment amount and input any amount you wish to pay. Click “Okay,” and the payment will be processed.

Which bank owns Migo Loan?

No bank owns Migo Loan, and Kunle Olukotun and Ekechi Nwokah founded the company. Nonetheless, Migo Loan partners with many Nigerian banks to provide financial freedom for people.

Bottom Line

Migo Loan is a genuine loan company that gives out easy loans to people without collateral or a guarantor, the interest rate is also low, and you get the money in a few minutes. If you have questions about the Migo Loan, visit any of the company’s customer support handles.

Advertisements