Advertisements

If you need to know all about Renmoney and its services, this post on Renmoney will help you understand them better.

I am sure you can relate to the difficulty attached to raising funds to start that business idea. Guess what? You don’t have to rely on loved ones and friends to raise the capital you need to get started. There are loan companies in Nigeria waiting for you to reach out to them, like Renmoney.

Renmoney is a microfinance bank that provides convenient lending opportunities to Nigerians. They offer both personal and micro-business loans ranging from 50,000 to six million naira.

INTRODUCTION

RenMoney Microfinance (formerly RenCredit) is a CBN-regulated fintech company that operates under a microfinance banking license. Renmoney was founded in 2012 as RenCredit but rebranded to Renmoney in December 2013.

Advertisements

RenMoney has grown remarkable over the years, having obtained a state licence to operate multiple locations in Lagos. They have offices in Surulere, Apapa, Lagos Island, Ikota, Ikeja, and Ikoyi. On November 7, 2018, RenMoney changed its head office from 89, Awolowo Road, Ikoyi, Lagos, to No. 23, Awolowo Road, Ikoyi, Lagos. The two offices are just a few blocks apart. Renmoney takes pride in its collateral-free, guarantor-free loan offers. The loan offers are specifically for salary earners and business owners in Nigeria.

RENMONEY SERVICES

Renmoney offers both personal and microbusiness loans, fixed deposit accounts, and savings accounts. The deposits and savings on Renmoney are insured by the Nigeria Deposit Insurance Corporation (NDIC). You can rest assured that your funds are safe with Renmoney.

Renmoney does not only provide small business loans but also offers personal loans to enable individuals to finance their needs, such as home renovation, buying a car, a smartphone, household appliances, sorting out emergencies, and so much more. Renmoney has a loan@work scheme that allows partner firms to provide finance to their employees at an affordable rate.

RENMONEY APP

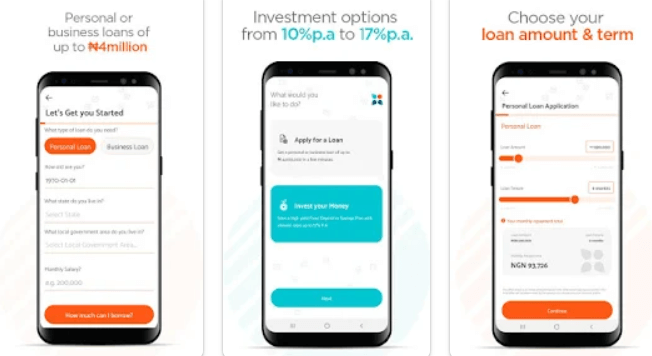

The Renmoney app is a loan app designed to cater to Nigerians. They fast-track loan applications and credit disbursements. They collect information with ease, verify loan applications, and disburse the money within 24 hours. The app is only available on Android and can be easily downloaded from the Play Store.

HOW TO DOWNLOAD THE RENMONEY APP

The Renmoney app allows individuals instant access to quick loans, savings, and investments with competitive interest rates. The loan application is a simple process.

You can easily download the app if you have an Android device and a stable internet connection.

For Android, to download the Renmoney app,

- Visit your Play Store or App Store and search for Renmoney.

- Download and install the app.

- After installation, launch the app.

- Click on “sign up” and follow the process step by step until you have successfully created an account.

HOW TO KNOW IF YOU QUALIFY FOR A RENMONEY LOAN

To be able to access the Renmaoney loan, you must:

- Be above the age of 22 and younger than 59 at both the application and loan repayment times.

- Be a salary earner or a business owner with a steady and verifiable source of income.

- You must live or work in a city where Renmoney operates.

- You must have a good record with the credit bureau.

- You must have a savings or current account with any commercial bank in Nigeria.

HOW TO APPLY FOR A RENMONEY LOAN

There are two ways to apply for a loan. You can either apply via the official Renmoney website or via the mobile app.

To apply via their official website, visit the website, input your information, and submit the necessary documents needed to process your loan application.

Some of the needed documents are:

- A valid government-issued ID( driver’s licence, passport, national ID card)

- 6 months bank statement

- Utility bill of at least 3 months to verify your home address. This could be PHCN, waste, a water bill, etc.

- Passport photographs

- Bank Verification Number (BVN)

To apply via the mobile app, you will need to download it from the Google Play Store. Please follow the instructions above on how to download the app. After you have signed up, you can input your information to apply for a loan and wait for Renmoney to give you feedback on their decision.

There are certain loan packages that are available for application on the mobile app but not on the website. This is one of the advantages of having the app installed on your smartphone.

HOW MUCH CAN I BORROW WITH RENMONEY?

The minimum loan amount is 50,000 naira, and the maximum is six million naira, as earlier stated. However, the amount you can borrow depends on your capability to pay back the loan, along with other factors such as your debt-to-income ratio. The amount of information you provide during the application process will be crucial to the amount of money you will be able to access. In addition, when you make your repayments on time and don’t default, you will be eligible for higher amounts and longer repayment tenors.

LOAN TENURE AND INTEREST RATES

The loan tenure with Renmoney ranges from 3 months to 24 months. The interest rate charged is dependent on your chosen repayment period and the amount borrowed. The longer the loan tenure, the higher the interest rate. However, the annual percentage rate ranges from 32% to 132.02%. There are no additional fees.

LOAN FEES AND PENALTIES

If you fail to pay back your loan during the agreed-upon period, there is a default fee attached. This fee accumulates every day after the period has expired.

BENEFITS ATTACHED TO RENMONEY LOANS

- Small business owners and salary earners in Nigeria have access to financial aid as quickly as possible, as long as they meet the requirements.

- Convenient repayment methods.

- No collateral or guarantor is needed.

WHY CHOOSE RENMONEY?

Renmoney is suitable for salary earners and business owners who need unsecured loans that can be paid within 24 hours.

Renmoney’s service is fast, convenient, and designed to meet your financial needs.

With Renmoney, you don’t need any collateral or guarantors.

With Renmoney, there are no hidden fees, and the repayment method is flexible.

RENMONEY CUSTOMER CARE SERICE NUMBER AND OFFICE ADDRESS

Go to the official Renmoney website and start a chat by sending a direct message.

- Call 07005000500 (9 a.m.–9 p.m.)

- Send a message to [email protected].

- Visit the head office or any Renmoney branch closest to you.

- Send a message through any social media platform (Facebook, Instagram, LinkedIn, and Twitter) to Renmoney.

FREQUENTLY ASKED QUESTIONS

If I receive my salary in cash, will I still be eligible for a Renmoney loan?

As long as you can provide evidence of income through a bank statement, you are eligible for loans.

Why does Renmoney need my BVN?

Renmoney needs your BVN to verify your identity. Your BVN is also used as a medium to protect you from theft so that someone who has access to your account number cannot use your account to access any loan without your permission.

Can I apply for a Renmoney loan as a student?

Yes, you can, as long as you are over 22 years of age and can prove to have a regular source of income.

Does Renmoney have USSD?

Yes. The USSD code for Renmoney is 723#. To request a quick loan, dial 723*73001#. To use this service, your phone number must be registered as an active payment method for Renmoney.

CONCLUSION

One of the most popular lending websites in Nigeria nowadays is Renmoney. It’s wonderful that they have a special flexible payback option since it makes borrowing money less stressful because you don’t have to worry about paying it back.

One of the few online lending platforms with a physical address where you can submit inquiries or complaints is this one.

We have been able to show you everything you need to know about Renmoney, their app, and how they operate.

We urge you to do your own research before making use of the app, and if you have been using the app, kindly drop your review in the comment section.

Advertisements