Advertisements

Did you know that new loan apps in Nigeria offer quick and easy loans with competitive interest rates and no collateral? If you are unaware of these loan apps, follow up on this article, as it discusses five new loan apps in Nigeria.

In recent years, the demand for loans in Nigeria has significantly increased due to various factors, such as the rising cost of living, unexpected expenses, and limited access to traditional financial institutions.

As a result, loan apps have emerged as a popular solution to this problem, offering quick and easy access to funds with minimal requirements and hassle-free processes. Whether you need a small loan for emergencies or a larger sum for business or personal needs, these loan apps offer various options to cater to your financial needs.

List of New Loan Apps in Nigeria 2023

The five new loan apps in Nigeria are currently listed below:

Advertisements

Blocka Cash

Blocka Cash is one of the new loan apps in Nigeria that offers convenient and accessible lending solutions. With its availability on Android and Apple app stores, Blocka Cash provides users easy access to short-term loans, making financial assistance more accessible.

Features

- Loan Amounts: N5,000 – N50,000

- The App is available on both iOS, Android,

- Interest rate: 3% per month – of 10% per month

- Annual Percentage Rate (APR): 36% to 120%.

- Loan tenure: 60 to 180 days

- Repayment channels: Debit Card, Quickteller, and direct transfer

Benefits

Access Short-Term Loans: Blocka Cash allows users to access short-term loans ranging from a minimum of N5,000 to a maximum of N50,000, depending on their credit score. This flexibility caters to various financial needs, whether for emergencies, personal expenses, or small business investments.

Convenience on Android and Apple: One of the notable advantages of Blocka Cash is its availability on both the Android and Apple app stores. This means that regardless of whether you use an Android device or an iPhone, you can easily download and install the App to access their loan services conveniently.

User-Friendly Interface: Blocka Cash boasts a user-friendly interface, ensuring a smooth and hassle-free experience for borrowers. The App is designed to be intuitive and easy to navigate, allowing users to apply for loans, manage repayments, and access relevant account information effortlessly.

Simple Application Process: The loan application process on Blocka Cash is straightforward and streamlined. Users can complete the application within minutes, providing the necessary details and documentation. Blocka Cash uses advanced algorithms to assess creditworthiness, making the approval process efficient and quick.

Fast Disbursement: Once a loan is approved, Blocka Cash ensures swift disbursement of funds. Users can expect to receive the loan amount directly into their bank accounts within a short period, enabling them to address their financial needs promptly.

Flexible Repayment Options: Blocka Cash offers flexible repayment options, allowing borrowers to select a repayment plan that best suits their financial capabilities. With transparent terms and conditions, users can easily understand the repayment terms and manage their loan repayments effectively.

Requirements

The requirements for a Blocka cash loan include the following:

- You must be at least 21 years of age.

- You should provide a valid Government ID card.

- You must have a good Credit score.

- You must be a Nigerian.

How to Download Blocka Cash Loan App

The Blocka cash is available on both Google Play and Apple Store. You can only download and install the APK file through the platform’s website. To download the APK file, follow these steps:

Step 1: Visit Blocka Cash’s Website

To begin, visit Blocka Cash’s official website. Look for the section labeled “Get the Android App,” which should have a link to download the APK file. Click on this link to proceed.

Step 2: Download the APK File

After clicking on the download link, the APK file will begin downloading to your device. It may take a few moments, depending on your internet speed. Ensure that you have a stable internet connection throughout the download process.

Step 3: Install the APK File

Once the download is complete, locate the downloaded APK file. You can find it in your device’s download folder or by checking your browser’s download history. Tap on the APK file to initiate the installation process.

Step 4: Allow App Installation from Unknown Sources

During the installation, your device may display a security prompt regarding app installation from unknown sources. This is necessary as you install the App from an APK file outside the Google Play Store. To proceed with the installation, select the “Allow” option.

Step 5: Launch the App

After the installation, you will find the Blocka Cash app in your device’s app drawer. Alternatively, you can click the “Open” button on the installation screen. Please tap on the app icon to launch it and begin using Blocka Cash’s services.

How to Apply For Blocka Cash Loan

Applying for a loan is a very simple process on Blocka Cash. Once logged into the App, navigate to the Loan section and fill in your personal and employment details for a loan request.

You will be asked to provide the following:

- Your details.

- Your employment details.

- A functional debit card.

After providing this information, you can apply for your desired loan amount and await approval.

Contact Details

Head Office: 1b Church Street, Off Ilo-Awela Road Ota, Ogun State

Email: [email protected]

Tel: +234 1 700 5289

P2Vest

P2Vest has emerged as a prominent player in the peer-to-peer lending industry in Nigeria, offering individuals a viable alternative for securing funding. With its robust platform, P2Vest connects borrowers with lenders and investors, providing an avenue for better returns on capital compared to traditional savings accounts and fixed deposits.

Features

Peer-to-Peer Lending: P2Vest is a peer-to-peer lending platform facilitating direct connections between screened borrowers and lenders or investors. This innovative approach eliminates the need for intermediaries, allowing individuals to lend or borrow money directly from one another. By cutting out the middleman, P2Vest offers borrowers competitive interest rates and investors attractive returns on their capital.

B2B Loan Platform: P2VFB: In addition to its peer-to-peer lending services, P2Vest also offers a dedicated business-to-business loan platform called P2VFB. The P2vest for business platform enables licensed lenders to seamlessly access the vast volume of borrowers on the P2Vest platform. It also allows businesses to set up their agents to lend on their behalf.

Flexible Loan Options: P2Vest offers borrowers various loan options to suit their needs. Individuals can borrow amounts ranging from N5,000 to N2,000,000, with flexible repayment tenures of up to 12 months.

The interest rate for each borrower is determined based on their credit rating, ensuring a fair and personalized approach to lending. P2Vest employs a dynamic interest rate system, which considers market rates and the borrower’s risk rating, ensuring transparency and flexibility.

Benefits

- No hidden charges

- Interest rates are dynamic based on your risk ratings and credit score

- Get money instantly

- Convenient payback plan

How to Download P2Vest Loan App

The P2Vest loan app is available for download on the Google play store and app store. You can also download the App from P2Vest’s official website. To this, follow the steps below:

Downloading through the Website:

Step 1: Visit the Official Website

To download the P2Vest Loan App, start by visiting the official website of P2Vest. You can easily access the website by typing “P2Vest” in your preferred search engine.

Step 2: Navigate to the Download Section

Once you are on the P2Vest website, navigate to the download section. Look for a prominent button or link that says “Download the P2Vest Loan App” or something similar. This section should provide the necessary information and instructions for downloading the App.

Step 3: Choose Your Device

Since P2Vest is available for Android and iOS devices, select the appropriate version of the App based on your device’s operating system. Look for options such as “Download for Android” or “Download for iOS” and click the corresponding button.

Step 4: Grant Permissions (for Android Users)

If you are downloading the P2Vest Loan App on an Android device, you may need to grant permission to install applications from unknown sources. To do this, go to your device’s Settings, navigate to the Security or Applications section, and enable the “Unknown Sources” option. This will allow you to install the App outside the official Google Play Store.

Step 5: Start the Download

Click the download button or link on the P2Vest website to initiate the download process. The download may take a few moments, depending on your internet connection speed.

Step 6: Install the App

Once the download is complete, locate the downloaded file on your device. This can usually be found in the “Downloads” folder for Android users. Tap on the APK file to begin the installation process.

Step 7: Grant Necessary Permissions

During installation, you may be prompted to grant certain permissions to the P2Vest Loan App. These permissions allow the App to access specific features on your device, such as contacts or location. Please read through the permissions and grant them as needed.

Step 8: Complete the Installation

Follow the on-screen instructions to complete the installation of the P2Vest Loan App. Once the installation is finished, you should see the App’s icon on your device’s home screen or app drawer.

Step 9: Launch the App

Locate the P2Vest Loan App icon and tap on it to launch the application. You must create an account or log in if you already have one. Follow the instructions to set up your account and use the P2Vest Loan App.

Downloading the P2Vest Loan App: Through Google Play Store and App Store

To download the P2Vest Loan App, you have two options depending on the device you use. Follow the steps below for your respective app store.

Option 1: Google Play Store (for Android devices)

Step 1: Open Google Play Store

On your Android device, locate the Google Play Store app from the app drawer or home screen. It typically has a colorful triangular icon.

Step 2: Search for P2Vest Loan App

Tap on the search bar at the top of the Play Store and type “P2Vest Loan App” into the search field. Hit enter or tap the search icon.

Step 3: Select P2Vest Loan App

Find the official P2Vest Loan App from the search results and tap on it to open the app page.

Step 4: Install the App

On the app page, click on the “Install” button. Review the permissions the App requires, and if you are comfortable with them, accept them by tapping “Accept” or “Install.” The App will then start downloading and installing automatically.

Step 5: Launch the App

Once the installation is complete, you can find the P2Vest Loan App icon on your home screen or in the app drawer. Tap on the icon to launch the App. Follow the instructions to set up your account and use the P2Vest Loan App.

Option 2: App Store (for iOS devices)

Step 1: Open App Store

On your iOS device, locate the App Store app from the home screen. It is usually represented by a blue icon with a white letter “A.”

Step 2: Search for P2Vest Loan App

Tap on the search tab at the bottom of the App Store and enter “P2Vest Loan App” into the search bar. Tap the search button.

Step 3: Select P2Vest Loan App

Find the official P2Vest Loan App from the search results and tap on it to view the app page.

Step 4: Install the App

Tap the “Get” or “Install” button on the app page. Authenticate with your Apple ID, if required, using Face ID, Touch ID, or your Apple ID password. The App will then start downloading and installing automatically.

Step 5: Launch the App

Once the installation is complete, the P2Vest Loan App icon will appear on your home screen. Tap on the icon to launch the App. Follow the instructions to set up your account and use the P2Vest Loan App.

Contact Details

Head Office: 9 Dauda Fasanya, Bexley Court, Ikate-Lekki

Email: [email protected]

Tel: +234 702 500 3549 , +234 913 936 6498

Umba Loan

The Umba loan app has emerged as one of the prominent new loan apps in Nigeria, providing individuals with access to personal loans. With Umba loans, you can borrow amounts starting from N1115 up to N89182 Naira at a competitive interest rate of 10% and a loan duration of 62 days.

How to Create an Account and Apply for Umba Loan

To avail yourself of an Umba loan and utilize the Umba Loan app effectively, here is a step-by-step guide:

Step 1: Register and Login

Begin by registering for an Umba account through the App. Once registered, log in using your 4-digit password to access your account.

Step 2: Access Loan Section

After logging in, locate and tap on the “Loan” icon within the App. This will direct you to the Umba Money Loan section.

Step 3: Connect to Your Bank

To proceed with the loan application, grant the necessary permissions, including SMS, phone, and location access. Additionally, complete the ID verification process by taking a selfie as instructed.

Step 4: Start Loan Application

Click the “Get Started” button to initiate the loan application process. If prompted, provide details of your debit card as requested.

Step 5: Select Loan Amount

Once on the Umba Money Loan screen, choose the desired loan amount from the available options.

Step 6: State Loan Purpose

Add a brief explanation stating the reason for your loan requirement.

Step 7: Confirm Loan Offer

Tap the “Confirm Loan Offer” button to confirm the loan offer. This step ensures that you are ready to proceed with the loan application.

Step 8: Await Loan Processing

After confirming the loan offer, patiently wait for the loan to be processed. This may take a short period.

Step 9: Check Umba Wallet

Once the loan processing is complete, check your Umba wallet to find the disbursed loan amount.

How to Download Umba Loan App

The Umba loan app is available for download on the Google play store and Apple Store. The App is only compatible with iPhone 13.0 version or later for iPhone users.

To download the Umba loan app from the Google Play Store or Apple App Store, follow the respective steps below:

Downloading Umba Loan App from Google Play Store:

- Open the Google Play Store on your Android device.

- Tap on the search bar at the top of the screen and type “Umba Loan” or “Umba Money.”

- From the search results, locate the official Umba Loan app developed by Umba Kenya.

- Please tap on the App to open its details page.

- Review the information on the App’s details page and check if it meets your requirements.

- To proceed with the download, tap on the “Install” button.

- The App will start downloading and will be automatically installed on your device once the download is complete.

- Once installed, you can open the Umba Loan app from your drawer and proceed with registration and loan application.

Downloading Umba Loan App from Apple App Store:

- Open the App Store on your iOS device.

- Tap on the search tab at the bottom of the screen and enter “Umba Loan” or “Umba Money” in the search bar.

- From the search results, locate the official Umba Loan app developed by Umba Kenya.

- Please tap on the App to view its details page.

- Please review the information provided and ensure it meets your requirements.

- Tap the “Get” or “Download” button to initiate the download.

- If prompted, authenticate the download using your Apple ID password, Face ID, or Touch ID.

- The App will begin downloading and will be installed automatically on your device once the download is complete.

- Locate the Umba Loan app on your home screen and tap on it to open. Proceed with the registration and loan application process within the App.

By following these steps, you can easily download the Umba Loan app from either the Google Play Store (for Android devices) or the Apple App Store (for iOS devices) and gain access to its features and services.

Contact Details

Tel:08168020812

Email: [email protected] or [email protected].

Yescredit Loan

YesCredit is a user-friendly loan app designed specifically for iPhone users in Nigeria. It provides access to low loan amounts, making it an ideal choice for individuals in need of quick financial assistance.

With YesCredit, you can borrow between N5,000 and N50,000. The application process is quick and easy, taking only a few minutes to complete. Once approved, the loan amount is swiftly credited to your wallet, allowing you to transfer it directly to your bank account without delays.

Features

One of the unique features of YesCredit is its loan limit increase. Every time you repay your loan in a timely manner, your loan limit is automatically raised. This means that as a responsible borrower, you have the opportunity to access higher loan amounts in the future.

Unlike traditional lending institutions, YesCredit does not require collateral, guarantors, or extensive documentation to grant you a loan. As long as you are over 21 years old, you can apply for a loan without any hassle.

However, additional documentation may be necessary to complete the application process for loans exceeding certain amounts.

It is important to note that YesCredit operates under the license of YesCredit Limited, a licensed money lender authorized by the Lagos State Government of Nigeria. This ensures that you are dealing with a legitimate and trustworthy lending platform.

If you are an iPhone user in Nigeria seeking a convenient and reliable loan app, YesCredit is an excellent choice. Its user-friendly interface, low loan amounts, and flexible borrowing terms make it a preferred option for individuals needing immediate financial support.

Benefits

- Interest rate: 4.5% – 35% with an equivalent monthly interest of 5%- 29%

- Annual Percentage Rate (APR): 29% – 120%

- Platform: iOS

- Loan Amounts: ₦5,000 to ₦50,000

- Loan tenure: 60 – 180 days.

- Repayment channels: debit/ATM card and direct transfer

YesCredit requires no collateral, guarantors, or documents for them to grant you the loan. Just make sure you are over 21 years old.

How to Download YesCredit Loan App

YesCredit loan app is available on Google Play Store and Apple Store.

To download the YesCredit loan app on your device, follow these steps based on your device’s operating system:

For Google Play Store (Android):

- Open the Google Play Store on your Android device.

- Tap on the search bar at the top of the screen.

- Type “YesCredit” into the search bar and press Enter.

- Look for the official YesCredit app in the search results.

- Please tap on the YesCredit app to open its store page.

- On the App’s store page, tap the “Install” button.

- Review the required permissions and tap “Accept” to install.

- Wait for the App to download and install on your device.

- Once the installation is complete, you can launch the YesCredit app from your app drawer.

For Apple App Store (iOS):

- Open the App Store on your iPhone or iPad.

- Tap on the search tab at the bottom of the screen.

- Type “YesCredit” into the search bar and tap the search button.

- Look for the official YesCredit app in the search results.

- Please tap on the YesCredit app to view its details.

- Tap the “Get” or “Install” on the App’s details page.

- If prompted, authenticate with Face ID, Touch ID, or your Apple ID password.

- Wait for the App to download and install on your device.

- Once the installation is complete, you can find and launch the YesCredit app from your home screen.

Note: Make sure you download the official YesCredit app from the respective app stores to ensure its authenticity and security.

Contact Details

Head Office: No. 11b Phase 2 Plaza, Beside FCMB Jakanda 1st Gate, Lekki-Epe Expressway, Lagos, Nigeria.

Tel: +2349131038044

Email: [email protected]

Irorun Loan

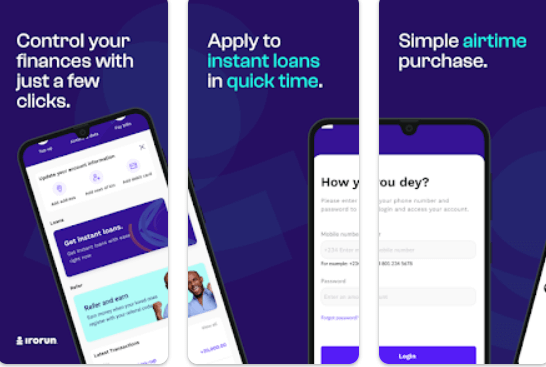

Irorun is a recently launched loan app exclusively designed for iPhone users in Nigeria. With Irorun, you can conveniently sign up and request a loan, which will be disbursed to you within minutes of approval.

Regarding accessing mobile loans in Nigeria, Irorun aims to provide a seamless experience and peace of mind. It is preferred for borrowers needing micro-credit solutions, specifically catering to small loan amounts.

By leveraging the Irorun app, you can easily navigate the loan application process and enjoy the benefits of swift loan disbursement. Whether you have urgent financial needs or require immediate cash flow, Irorun strives to deliver quick and efficient loan services to iPhone users in Nigeria.

Features and Benefits

- Annual Percentage Rate (APR): 29% – 120%

- Loan tenure: 60 – 180 days.

- Only available on iOS

- Loan Amounts: N2,500 – N50,000

- Interest rate: 4.5% – 35% monthly interest of 5%- 29%

- Repayment channels: Manually or via the auto-debit service.

How to download the Ilorun loan app in Nigeria

To download the Ilorun loan app in Nigeria, you can follow these simple steps:

For Android (Google Play Store):

- Open the Google Play Store on your Android device.

- Tap on the search bar at the top of the screen and type “Ilorun Loan” or “Ilorun Loan App,” and press Enter.

- Look for the official Ilorun loan app in the search results. It should have the App’s logo and developer information.

- Please tap on the Ilorun loan app from the search results to open its app page.

- On the app page, click on the “Install” button.

- Review the required permissions for the App, and if you’re comfortable with them, click “Accept” to start the download and installation process.

- Once the installation is complete, you’ll find the Ilorun loan app icon on your device’s home screen or in the app drawer.

- Tap on it to launch the App.

For iOS (App Store):

- Open the App Store on your iPhone or iPad.

- Tap on the search tab at the bottom of the screen and type “Ilorun Loan” or “Ilorun Loan App” in the search bar.

- Look for the official Ilorun loan app in the search results. It should have the App’s logo and developer information.

- Please tap on the Ilorun loan app from the search results to open its app page.

- On the app page, tap on the “Get” button, which will change to “Install” after you tap it.

- Authenticate the download using Touch ID, Face ID, or your Apple ID password.

- The App will start downloading and installing on your device.

- Once the installation is complete, you’ll find the Ilorun loan app icon on your device’s home screen. Tap on it to launch the App.

Now you can enjoy the convenience of the Ilorun loan app and explore the loan services it offers to users in Nigeria. Remember to create an account and follow the App’s instructions to request loans through the Ilorun platform.

Contact Details

Head Office: 1B, Church Street, Off Ilo-Awela Road, Ota, Ogun State

Tel: +234 1 700 5288

Email: [email protected]

Frequently Asked Questions

Can I increase my loan limit with these apps?

Some apps, such as YesCredit, offer the possibility to increase your loan limit over time as you repay your loans promptly. However, it is subject to the App’s policies and your creditworthiness.

Do these loan apps require collateral or guarantors?

Generally, these loan apps do not require collateral or guarantors for smaller loan amounts. However, some apps may request additional documentation or collateral for larger loan amounts.

Are loan apps safe in Nigeria?

Most loan apps in Nigeria are safe to use, but users should be cautious and only use loan apps from reputable companies with valid licenses from regulatory bodies.

Bottom Line

In conclusion, Nigeria’s five new loan apps offer convenient and accessible financial solutions to individuals and businesses needing quick loans. Whether you’re looking for personal loans, peer-to-peer lending, or micro-credit options, these apps have you covered. From Blocka Cash and P2Vest to Umba, YesCredit, and Ilorun, each App provides unique features and benefits to cater to different borrowing needs.

Users can swiftly access the loan services offered with the ease of downloading these apps from the Google Play Store or the Apple App Store. These apps prioritize user experience, ensuring a seamless and efficient loan application process. Moreover, they utilize advanced technologies and algorithms to determine loan eligibility and interest rates, making borrowing more transparent and personalized.

It’s important to note that while these loan apps offer convenient access to funds, responsible borrowing practices should be followed. Borrowers should carefully review each App’s terms and conditions, interest rates, and repayment schedules to make informed decisions.

As the fintech industry continues to evolve in Nigeria, these new loan apps contribute to individuals’ and businesses’ financial inclusion and empowerment by providing flexible and accessible loan options.

Advertisements