Advertisements

The Impact of Technology Based Self Service Banking Service Quality on Customer Satisfaction – a Case Study of the Nigerian Banking Sector

CHAPTER TWO

Literature Review

Introduction

This chapter presents the literature on the impact of TBSSB on customer satisfaction. Service quality and TBSSB are of central importance in this study. This literature review focuses on the topics of customer service quality, technology self-service, customer satisfaction, the historical evolution and development of the Nigerian banking sector. The Attribute Based Model and the Discrepancy Theory will be used to analyze the data. The research on customer satisfaction was also discussed.

2.2 Brief Historical Evolution and History of Banking in Nigeria

The Nigerian banking industry can be observed to have emerged through the colonial era, with the formation of a colonial bank called the African Bank Corporation (ABC) in 1892 (Toluwani, & Soasan, 2010). The colonial bank started operation of business as a result of the merchant population’s banking operations which commenced in Lagos in the year 1894. In 1990 a new branch was opened in Calabar. The bank was functioned by England during the foreign era before its establishment in Lagos, Nigeria. The emergence of commercial banks and later the deregulation of the Central Bank of Nigeria brought about computerization and digitization of banking in Nigeria (Oluduro, 2015).

This transformation resulted in the use of technology in the delivery of their service and operation to customers. In 1986, massive development, growth, transformation, and physical adjustment brought about changes into the year 1991.The first commercial indigenous bank was the First Bank of Nigeria (FBN).We know that the Foreign Bank was established later in 1925, to become the Barclays Bank of the Dominion Colonies Overseas (DCO) (Ikpefan, 2006). By the year 1991 the total number of commercial and merchant banks had increase to one hundred and twenty one. This is made up of Sixty six commercial banks and fifty five merchant banks in Nigeria.

Advertisements

The Federal Government of Nigerian by then licensed twenty new banks in the year 1991 to commence full operations as a result of the deregulation of some commercial banks (Ofoegbu & Iyewumi, 2013). In addition, between the year 1994 and 2003, there was a strong deregulation of the commercial bank because of the loss of wealth in public confidence in the system and challenging monetary management by the year 2004 (Zontangos & Anderson, 2004). Also by then there was merger and acquisition, which resulted into the reduction of commercial banks from 89 to 25. This arose from the policy which affected the commercial banks with a capital below 25 billion have had to merge. By the year 2004, there was a policy order from CBN that banks need to jerk up their capital paid up. A lot of commercial banks resisted the change, but the orders were irreversible (Oluduro, 2015). By the year 2006, there was only twenty five commercial bank in the country due to the major shake up country policy by the central bank of Nigeria.

2.3 Customer Quality Service and TBSSB

Customer service quality, which means ensuring customer satisfaction at all times, has become a major factor of consideration in determining the success and growth of organizational enterprise (Djajanto, Nimran, & Kumadji, 2014). Service quality refers to the general evaluation of service delivered through electronic channels, such as the Internet, telephone lines and or automated services. Santos (2003) examines the relationship between service quality, customer satisfaction and self-service technology. Similarly, Dabholkar, Michelle, and Lee (2003) assessed the use of self-service technology and found that customers have begun to accept the new way of accessing various e-services including banking services.

In addition Meuter, Ostrom, Roundtree, and Bitner (2000) reported an increase in the number of financial institutions that were using self-service and other service technology such as Automated Teller Machines (ATM), telephone and internet banking, as well as mobile application banking. All of these could be utilized on various independent platforms to meet the customers’ needs without support from the bank staff. Another impact of technology self-service on customers satisfaction was reported by Zameer, Tara, Kausar, and Mohsin (2015). In their case they found that the corporate image had an effect on customers’ perceived value of the service. This encouraged the banking sector to pay more attention to their customer’s perceived value by improving their service quality. Adewoye (2013) on his part focuses on mobile banking which he believes provides positive influence on service delivery at retail banks in Nigeria.

Technology service quality has been looked at by Akinyele and Olorunleke (2010) as enhancing the affiliation between service quality, customer satisfaction and financial performance in electronic banking. The study aimed at testing some serious attitudinal factors influencing customer intention to use TBSSB. Parasuraman, Zeithaml, and Malhotra (2005) construct a framework called “means-end”, which they used as a theoretical foundation that conceptualizes, constructs, and refines the Test Divers Item scale which measures electronic service quality.

2.4 Customer Satisfaction in TBSSB

Customer satisfaction in a business world, can be defined as a method by which services and products are supplied and delivered by industry in order to meet the customer’s expectation. Customer satisfaction, could also be viewed as the feelings and judgment of quality service as experienced by the customers (Jamal & Naser, 2003). It is generally agreed that customer satisfaction is fundamental in ensuring business is successful. When customers are fulfilled with a business contract, it will ensure market growth for the organization in the near future. The impact of TBSSB on customer satisfaction has been found to be influenced by service quality in a study conducted by Kumbhar (2011) which considered the mobile banking technology. On the other hand, Iberahim, Taufik, Adzmir, and Saharuddin (2016) examine the dependability and responsiveness of Automated Teller Machine (ATM) and how it determines customer satisfaction. Customer satisfaction presents an evaluation framework for the sustainability of technology systems and excellence management (Dilijonas, et al. 2009).

The impact of technology on excellence in service delivery was reviewed by Parasuraman and Grewal (2000) and the authors developed a model that assimilates quality and value by using the “Pyramid Model”. This model is used for highlighting the significance of technology on customer satisfaction. In a different situation in the United Kingdom, self-service was also studied with the aim of understanding customer motivation, customer intention, market orientation, segmentation, and online shopping (Jayawardhena & Foley, 2013). However, studies of TBSS cannot be complete without mentioning the work of Yang and Fang (2004). They added to the understanding of service quality and atmosphere setting for virtual security business services. Yang and Fang in their conceptual framework of services and advertising of information management systems, show that service quality can also be credited to network

operational platforms, using an effective and efficient online delivery of product and services. Zeithaml, Parasuraman, and Malhotra (2002) assert that service delivery through website should include a construct and criteria by which the customer can evaluate electronic service quality online. That customer evaluation process would reveal customers perception and satisfaction with self-service technology banking ( Yang & Park, 2009).

A lot of studies have been used to discourse the issues of customer perception of the service quality measurement and satisfaction in the old-style service checkout. However not enough has been done to study customer perception and satisfaction in relation to TBSSB. Further literature has examined the impact of TBSSB on customer satisfaction. In one such study, Jun, Yang, and Kim (2004) assert that customer satisfaction has the following attributes relevant to banking such as: reliability, efficiency and security. In concurrence Zeithaml et al. (2002) view that researchers have reportedly recognized the above service quality attributes as fitting into the online business environment. Similarly, Yoo and Donthu (2001) developed an operational measurement quality such as processing speed, ease of use etc. Arasli, Turan, and Mehtap‐Smadi (2005) compare service quality in the banking industry, by examining customer satisfaction and how it varies one industry to the other. The aim of the study is to empirically discover the relationship between the service aspect and customer satisfaction.

2.5 Service Quality

Service quality has been broadly studied within the field of Business Management and Information Systems. A lot of views and definitions have been given and offered (Wang, 2011). However, none of the definitions was accepted. It is therefore important, to begin with a new discussion of the definition of service quality for the purpose of the study. Service quality differs from accomplishment services as deed. Some researchers view service as activities, benefits or efficacy delivered in connection with the purchase and sale of goods. “Electronic service can also be referred to as performance that is facilitated by information systems” (Parasuraman et al., 2005, pp. 1-21).

Service quality is defined as how customers evaluate a product or services, especially when customers show a positive motivation in consuming the product (Jun et al., 2004). Service quality is significant in service and information management, especially for financial institutions which are seen as encompassing different characteristics of skilled service transaction. Unlike in the traditional service encounter, service quality has now been replaced by technology, because now most customers encounter new technology (Meuter, Bitner, Ostrom, & Brown, 2005). Service quality has to do with lowering of cost, and improving of efficiency and security (Yang & Fang, 2004). In a similar study by Wang and Harris (2003) service quality and customer satisfaction are considered to be the central point of assessing how service is rendered by an organization to its customers, and which can be measured on a typical measuring scale. Service Dimensions in the context of service quality can refers to the associated factors of Technology banking which influences customer satisfactions.

Bebli (2010) asserts that some research work shows ways of measuring service quality of Internet banking such as: reliability, control, and privacy that have influence on the user, the study uses theoretical perspectives of customer satisfaction. Sakun (2015) empirically tested a model for the purpose of protecting automated satisfaction in the digital banking systems and his research outcomes show that technology willingness has impact on service quality of self-service technology.

Similar work by Gunawardana, and Perera (2015), explored the perceived quality of self- service technologies and its effects on customer satisfaction. The result of their work gives the association between service associated dimensions such as ease of use, reliability, efficiency and ease of use etc. Djajanto, Nimran, and Kumadji (2014), examined the relationship among the self-service technology (SST), the service quality, relationship marketing on customer satisfaction and loyalty. From the literature, we can establish that self-service technology is linked with the service quality dimension. The investigator has narrowed his research on customer satisfaction in Nigeria in the banking industry with the aim of identifying the impact of service quality on customer satisfaction. Zameer et al. (2015) says providing exceptional service TBSS has embraced the association between the users of the technology and service workers. Ngo and Nguyen (2016), in a similar study determine the association among service quality, fulfillment and social purpose in a Malaysia spa where customers relate and talk services using the technology self-service. Nimako, Azumah, and Donkor (2012) led a study to how the quality of service and information system would be confirmed to satisfy the customer.

2.6 Attribute Based Model in Information System (IS) Research

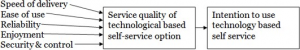

Technology Based Self-Service (TBSS) has a significant feature which has been used by customers to evaluate TBSS and its use. The Attribute Based Model according to Dabholkar (1996) is an appliance for dimension of the service quality of TBSS. This model is relevant because it has studied how the need of customer collaboration in using technological service impacts the customer’s intention to use it (Yen, 2005). The model however reveals that based on the degree of collaboration with the technology, the customers have adopted new perceptions about TBSS. The expected service attribute, the associated service quality and dimension are significant measurement in the study of TBSSB. In this study an attribute of service quality was added, which is efficiency to investigate the TBSSB impact of quality service and associated factors on consumer satisfaction.

There are five quality factors to consider when studying ‘TBSSB’. In our research we have asked the following questions regarding the influence of these service quality factors of customer satisfaction:

- How do associated service quality factors influence customer satisfaction?

- What is the relationship of the associated factors and customer satisfaction?

- What impact does the TBSS service quality dimension have on customer satisfaction?

In a similar study (Seth, 2005) asked similar questions on the use of service quality of customer satisfaction. The customer’s choice can be measured using this model upon which the quality service associated factors stand. The Attribute Based Model has an observation method. This model shows the relationship between quality service and the SST characteristic which can be used to assess an increase in the quality of service and lead to use of technology service. The Attribute-Based Model has been used as an approach and collaborator between the customer and technology (Dabholkar et al., 2003). The Attribute Based Model is considered as a significant measurement of service quality and associated factors. The model further describes that the associated factors of quality measurement can lead to intent to use technology based self-service banking.

The first construct of the Attribute Based Model is speed of delivery. This is the actual stipulated amount of time between the time of delivery of a service and the waiting time. The second construct in the Attribute Based Model is convenience. This means ease of use of the technology service with limited risk. It also shows the user’s ability to use the technology with ease. That information on the technology can be viewed at a convenient time. The factor have been found and suggested as significant factors that influence the objective to use TBSS (Lee, & Allaway, 2002). Another construct of the Attribute Based Model is “reliability; reliability has to do with continuous correct functioning of the technology system, and can be depended upon at all times” (Kumar & Bose, 2013). Reliability of service has influence on user control and the satisfaction of service to be delivered.

Enjoyment of service as one of the constructs of Attribute Based Model is the stimulating and the satisfying perceived nature of the technology, which fascinates more businesses that are curious about using it. “Enjoyment is one of the most relevant attributes when evaluating service quality”( Demirci and Kara, 2014, p.21). When the self-service technology consumes more time to process than the customer expected, the customer would not be excited because it is time consuming.

The last construct of Attribute Based Model is Control/Security. This is an essential attribute valued by customers. Control and security are central in measuring impact of the self-service technology (Yen, 2005). Security can be a limitation to customers when they are executing transactions on SST. A research work has been done on the association between the service quality and the technology banking service. Service quality has been establish to be significant in the use of technology in the customer employee relationship (Parasuraman & Grewal, 2000).

The model of TBSS includes the concept of service quality, and five other attributes of self- service technology for customer satisfaction (Zameer et al., 2015). However, users of service quality are assumed to be more favorable with ease of use of the technology. Accessibility has a positive impact on the customer when they are interested of using the technology (Davis, 1989). When service technology is not properly strategic that may cause the user to find difficulty in its use. Security and control are important elements in assessing service quality with TBSS. Which means the customer finds the system reliable and secure. Secondly dependability has been found to be a significant measurement of service excellence (Parasuraman et al., 2005).Users should identify security as important measure of self-service development which allows the customer to find the best way to meet his demand. The model below shows the Attribute Based Model and the corresponding model construct.

Figure 1: Shows the Attribute Based Model (Adapted from Dabholkar, 1996).

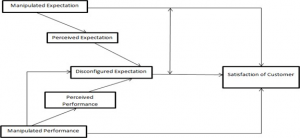

2.0 Discrepancy Model in Research of Satisfaction in Information Systems

Discrepancy theory of research in Information Systems, provides a structure into the investigation of user satisfaction and expectation. It has been used broadly, most especially in information system (Jiang & Klein, 2000). Customer satisfaction can be refers to as a “post choice evaluation which varies whether the user experience of using purchasing a specific good as it supposed to be, is a vital indicator of service quality” (Ardabili, Daryani, Molaie, Rasooli, & Kheiravar, 2012, pp. 8637-8643). Satisfaction can also result from successfully evaluating a stakeholder’s skill concerning information systems and services (Wynne & Chin, 2000).

Expectation is a construct that refers to redirect predicted performance, considered in different ways as intended element of assessment to another referent Jiang and Klein (2000). The third construct is performance. Performance in customer satisfaction field can also be value as a product which can add value to the system. We therefore, use the customer satisfaction construct to enables us describe the concept of service quality and TBSS on customer satisfaction. Satisfaction of customer is a benefit to disconfirmation. Disconfirmation is what happens when customer expectation is not met. Dissatisfaction happens when the customer expection and performance fails as shown in the diagram below.

Discrepancy occurs when there is a mismatch among the expectation and apparent performance. Discernment of performance is the presentation met anticipation which all lead to customer satisfaction. A lot of focus has now shifted to customer disconfirmation and show effort on satisfaction (Jiang & Klein, 2000). Their finding suggests that performance is not a dominant predictor of satisfaction.

The discrepancy model in information systems describes how customer satisfaction, perceptions of technology systems, and service delivery influences the user (Wixom & Todd, 2005). The model further explains how the consumer satisfaction as a “feeling with regard to the experience of a specific purchase was honest” (Henard & Szymanski, 2001, pp. 362-375). However this study aims at identifying the service quality and related factors of TBSSB and their influences on customer satisfaction in the banking industry in Nigeria.

Customer satisfaction research has been used in diverse studies in information system research, as the measurement of service quality of a product or service (Jiang & Klein, 2000). Customer Satisfaction as a construct has been succesfully explained in the planned behaviour theory, which looks at the relationship between attitude and desire consequence. When users are satisfied with the system, they tend to use the systems it could be as the result of customer satisfaction.

Others Models have been developed in the past to capture the fundamental structure of expected consumers and consummation in information systems research (Au, Ngai, & Cheng, 2002). The influence may vary on satisfaction according to the background of the discrepancy theory. Though the philosophy may seem to be simple in perception and application there are difficulties in the use of theory in research (Jiang & Klein, (2000).

The discripancy theory plays an imperative role in accepting customer satisfaction research. The discrepancy theory which was used in personal management and other management related research work is basically on hierachy of need (Paula, Phillips, & Lazarova, 2001). Research on descrepancy theory has told us how the theory was used in a number of ways. The theory have been applied in job satisfaction Jiang and Klein, 2000). The philosophy will be used in this research, to see how the service quality of TBSS impacts customer satisfaction. We adapted the variable customer satisfaction to fit into the theoretical model to provide a general background for the study of how the service quality TBSS impact customer satisfaction in Nigeria.

Figure 2: Discrepancy Theory Models of Satisfaction in IS Research(Jiang & Klein, 2000)

2.0 Associated Quality Service Factors In TBSSB

Electronic and technology banking have changed the traditional banking system because of different techniques which are implemented by the financial service provider (Cavus, Netsai, Chingoka, and East, 2015). Information technology has enabled TBSS and has made it easier for people to communicate, transmit and conduct businesses. TBSS has made customer transaction processing faster. Self-service technology research has investigated the use of technology speed, design interactivity and security control (Jayawardhena & Foley, 2013).

Similarly Broderick and Vachirapornpuk (2002) are of the opinion that the nature of the customer and the involvement have impact on the quality of service experience. Another issue of interest is the degree to which the customer recognizes his ability to determine his satisfaction in the banking system. Jayawardhena (2004)has looked at the effect of quality service in assessing technology self-service and the customer satisfaction in the banking industry. Also Jun et al. (2004) agree that there is a need for consideration to be made regarding the customer perception in self-service technology banking and customer satisfaction. There is also a comparison to be made between service quality, customer satisfaction and other conceptual characteristic of service quality.

Advertisements