Advertisements

Got a pressing need that requires some cash ASAP? You’re not alone! These days, instant loans are all the rage in Nigeria. More and more people are turning to them to solve their urgent financial dilemmas quickly. And guess what? Specta Loan is at the forefront of this lending revolution! In this article, we will cover how to borrow from Specta, requirements for loans, etc.

About Specta Loan

Specta Loan is affiliated with Sterling Bank, one of the leading banks in Nigeria. Sterling Bank is the financial institution that supports and provides lending services for Specta Loan. Specta Loan offers flexible loan amounts, competitive interest rates, and varying repayment periods to suit borrowers’ needs. The loan application is evaluated based on factors such as creditworthiness and income verification.

Requirements To Borrow From Specta Loan

To apply for a loan from Specta, you will need to provide the following information and documents:

- Full Name: Your complete legal name is required for identification purposes.

- Name of Workplace: Provide the name of your current employer or the company where you work.

- Date of Birth: Your birthdate is needed to confirm your age and eligibility for the loan.

- Phone Number: A valid contact number is necessary for communication regarding your loan application and repayment.

- Email Address: You must provide an active email address to receive updates and notifications from Specta.

- Account Number (NUBAN): Your bank account number is required for depositing the approved loan amount.

- Bank Verification Number (BVN): Your BVN is necessary for identity verification and to ensure the security of your loan application.

How To Apply For Specta Loan

To apply for a Specta loan, follow these steps:

Advertisements

- Visit the Specta loan application page by typing “https://www.myspecta.com/apply/Default” into your internet browser’s address bar and press Enter.

- You’ll find a form on the website that requires your personal information. Enter your full name, date of birth, phone number, email address, bank account number (NUBAN), and bank verification number (BVN). Make sure to provide accurate and up-to-date information.

- Specta will likely offer various loan packages with different amounts and interest rates. Choose the loan package that suits your needs and financial situation.

- Once you’ve selected the loan package, you’ll be directed to an application form. Complete the form with all the necessary details and double-check for any errors.

- After filling out the application form, review all the information you’ve provided to ensure it is correct. Then, click on the “Submit” or “Apply” button to send your loan application to Specta.

- Specta will review your application, including your creditworthiness and other factors. If your application is successful and meets their criteria, your loan will be approved.

- Upon approval, the loan amount will be credited to your bank account immediately or within a short period of time, depending on your bank’s processing time.

Interest Rate For Specta Loan

The interest rate charged on the loan varies between 25.5% and 28.5%. The specific rate you receive depends on factors such as your risk rating and other considerations. This interest rate determines the cost of borrowing the funds.

requires a one-time payment for insurance, which amounts to 2.5% of the loan. This fee helps protect both you and the lender in the event of unforeseen circumstances that could affect loan repayment.

There is a one-time payment known as a management fee, which is set at 1% of the loan amount. This fee covers the administrative costs associated with processing and managing your loan.

Specta Loan Packages

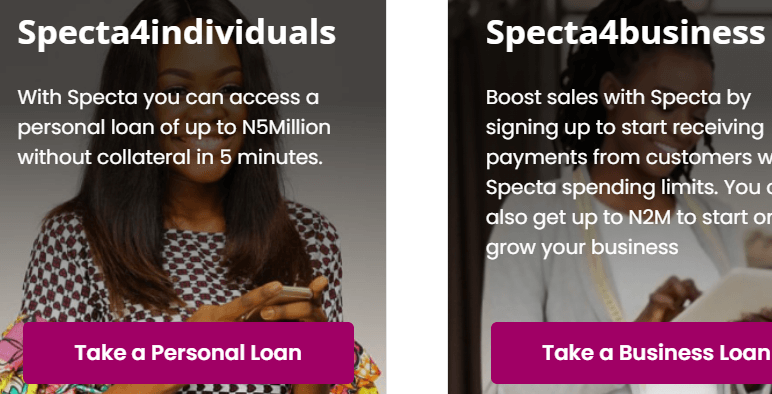

Specta4Individuals

Specta4Individuals offers a personal loan package designed to meet your financial needs. Here

Loan Amount:

- You can access a personal loan amount of up to a maximum of N2 million naira.

- If your company is part of the Sterling Community and boarded on the Specta platform, you may qualify for a higher loan amount of up to N5 million.

Eligibility:

- Salaried Individuals: If you have a salary account with any bank or with Sterling Bank, you are eligible for a personal loan.

- Non-Salaried Individuals: If you are self-employed, a business owner, a professional, or a trader with accounts in any bank or with Sterling Bank, you can also access a personal loan.

Loan Tenor:

- You can choose a loan tenor of up to 12 months.

- For members of the Sterling Community, the loan tenor can be extended up to 36 months.

Interest Rate and Fees:

- The interest rate charged on the loan varies between 25.5% and 28.5%, depending on your risk rating.

- There is a management fee of 1% and an insurance fee of 2.5%.

- If your company is part of the Sterling Community, special rates have been pre-negotiated with your HR Manager or company representative.

Specta4Busines

Spectra Business offers a loan package specifically designed to cater to the needs of businesses.

Eligibility:

- Businesses must have been operating for a minimum of 6 months.

- A valid bank account is required.

- Proof of income and meeting additional eligibility criteria are necessary.

Loan Features:

- When you opt for a cash loan, the available repayment tenor ranges from 7 to 12 months.

- The interest rate for Specta4Business loans is 23% per annum or 1.92% monthly.

- An insurance fee of 2% per annum is applicable.

Competitive Interest Rates:

- Specta4Business offers competitive interest rates, ensuring that businesses can access funds at favorable terms.

Flexible Repayment Terms:

- The loan package provides flexibility in repayment terms, allowing businesses to choose a repayment tenor that suits their cash flow and financial capabilities.

USSD Code For Specta Loan

Specta Loan does not provide a USSD code option for loan applications. If you wish to borrow a loan from Specta, you will need to utilize the website option. This means that you must visit the Specta Loan website and follow the instructions provided to apply for a loan.

Customer Reviews

Customer service agents have no clue other to say “I am sorry”. Please avoid the loan offer as they are simply helping themselves to our funds and hardly give anyone a positive outcome. By Paul Banjoko, Quora

I applied for a loan April 28th 2023…and my repayment is scheduled for ten months.. starting from May 28th 2023. Can you believe that today is May 16th 2023 and yet loan hasn’t been disbursed and I’m expected to start repayment by 28th of May and the worst scenario is that they’ve taken 12 cheque book leaflets from me.. Specta is a trap. By PASCAL CHINEDU, Quora

Customer Care Details

For assistance with Specta loan-related inquiries and concerns, you can reach out to their customer care team using the following contact details:

Benefits Of Specta Loan

- Specta Loan provides a user-friendly online platform where borrowers can easily apply for loans from the comfort of their homes or offices. The application process is streamlined and can be completed quickly, saving time and effort.

- Once a loan application is approved, Specta Loan aims to disburse the funds to the borrower’s bank account within a short period, often in minutes. This quick disbursal allows borrowers to address their financial needs promptly.

- Specta Loan offers varying loan amounts based on individual needs. Borrowers can access personal loans ranging from smaller amounts up to millions of naira, depending on their eligibility and requirements.

- Specta Loan provides competitive interest rates, ensuring that borrowers can access funds at favorable terms. The specific interest rate is determined based on factors such as the borrower’s risk profile and repayment capacity.

- Specta Loan offers flexible repayment options to suit borrowers’ financial situations. Repayment periods can range from 1 to 12 months, allowing borrowers to choose a duration that aligns with their cash flow and ability to repay the loan.

Customer Care Numbers

You can call the Specta Loan Customer Care on 01–4484481 and 07008220000 for card activation. These numbers are available for you to speak directly with a customer care representative who can assist you.

Complaints

If you have a specific complaint or issue that you would like to address, you can visit the Specta Loan website and go to the contact page at https://www.myspecta.com/apply/contact.html. There, you will find a form that you can fill out to provide details about your complaint. Specta Loan will review your submission and work towards resolving the matter.

Frequently Asked Questions

What kind of loans does Specta offer?

Specta offers a range of loan products, including Personal loans, Household/Asset Acquisition loans, and Salary Advance. These loan options cater to various financial needs, providing individuals access to funds for personal expenses, acquiring assets, or receiving salary advances.

How long does it take to receive the loan funds after approval?

Once your loan application is approved, Specta will disburse the funds directly to your bank account within a few minutes. The exact timing may vary depending on your bank’s processing time.

Can I apply for a loan from Specta if I am self-employed or a business owner?

Yes, Specta Loan is available to both salaried individuals and non-salaried individuals. Non-salaried individuals, including self-employed individuals, business owners, professionals, traders, etc., can apply for a personal loan if they have accounts with any bank or Sterling Bank.

Can I repay the loan before the end of the agreed-upon term?

Yes, you have the flexibility to repay your loan before the end of the agreed-upon term.

Conclusion

Specta offers a convenient and streamlined online application process, quick disbursal of funds, flexible loan amounts, and competitive interest rates. It provides loan options for both individuals and businesses. While Specta Loan does not have a USSD code, the loan application can be completed through their website.

Customer care support is available for inquiries and complaints. However, you need to consider customer reviews and experiences before applying for a loan.

Advertisements