Advertisements

In South Africa, being blacklisted can be a serious challenge when it comes to getting financial assistance needed. Regardless, Capitec, a distinguished bank in the country, presents potential solutions for individuals facing this predicament.

Today, we will analyze the concept of blacklisting, and try to demystify Capitec’s approach towards lending, and highlight the available loan options for blacklisted individuals at Capitec.

Understanding Blacklisting

First of all, what is blacklisting? What does it mean to be blacklisted?

Blacklisting refers to a situation where an individual’s credit history is negatively affected as a result of missed payments, defaults, or excessive debt.

Advertisements

Being blacklisted can severely impact a person’s capacity to secure loans or credit from conventional financial institutions.

It is necessary to note that Capitec, like other banks, carries out credit assessments before approving loan applications.

But then, Capitec’s approach differs from conventional banks in terms of calculating risk and delivering financial solutions to those who have been blacklisted.

Capitec’s Lending Philosophy

Capitec Bank seeks to be inclusive and deliver accessible financial services to all South Africans without bias.

Their lending philosophy is concentrated on an individual’s affordability instead of solely relying on credit history.

Capitec checks out various factors such as income, expenses, and financial behavior when assessing loan applications.

This approach enables the bank to assess applicants who may have faced financial difficulties in the past but are now competent at repaying loans.

Loan Options for Blacklisted Individuals

Capitec offers many loan options for individuals who have been blacklisted. Let’s look through them.

Global One Credit Facility

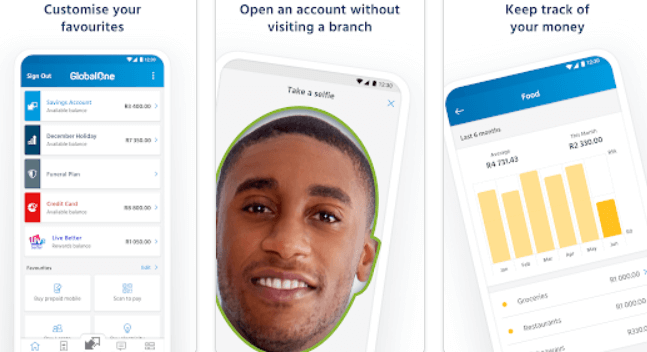

The Global One Credit Facility is a flexible and suitable credit solution offered by Capitec.

It gives customers an overdraft facility that can be used as a loan when needed.

This credit facility enables blacklisted individuals to get funds up to an approved limit. The interest is charged only on the amount used and only adds up daily.

Multi Loan

Capitec’s Multi Loan is another possible option for blacklisted individuals. It is a short-term loan with a fixed repayment term of one to six months.

The loan amount and repayment term are decided based on the individual’s affordability and credit profile.

Blacklisted individuals can apply for a Multi Loan online or through Capitec’s mobile banking app.

Quick acceptance and disbursal make it a great choice for those in urgent need of funds.

Personal Loans:

Capitec also gives personal loans. They are particularly designed for individuals who have been blacklisted.

These loans give financial assistance for various purposes, like debt consolidation, home improvements, or unexpected expenses.

Loan amounts vary from R1,000 to R250,000, and repayment terms can be customized to fit your financial situation.

Consolidation Loans

If you are struggling with numerous debts and finding it tough to manage repayments, Capitec’s consolidation loans can be a great option.

This type of loan enables you to merge all your existing debts into a single loan, simplifying your repayment process.

Consolidation loans assist you in consolidating your debts and potentially decrease your overall monthly payments.

Revolving Credit

Capitec’s revolving credit facility, also called a credit facility, is another alternative available for blacklisted individuals.

It functions as a flexible credit line that you can utilize as needed.

With a credit facility, you have a pass to funds up to an approved limit, and you only pay interest on the amount you get.

This revolving credit option lets you borrow and repay as per your necessities.

Overdraft Facility

Capitec also delivers an overdraft facility for blacklisted individuals who hold a Capitec transactional account.

This facility gives you the option of additional funds when your account balance is insufficient to cover your expenses.

The overdraft is subject to approval and can be a great option for managing short-term financial gaps.

NOTE! The availability of these loan options and the specific terms and conditions may differ depending on your individual cases and Capitec’s assessment.

When contemplating any loan, it is advisable to thoroughly review the terms, interest rates, and repayment obligations to make an informed decision that fits your financial capabilities and goals.

Requirements and Application Process

To apply for a loan at Capitec, when you have been blacklisted, certain eligibility criteria have to be met. These criteria typically include:

- Age: You must be at least 18 years old to apply for a loan.

- Identification: You need to provide a valid South African ID document.

- Employment: Capitec requires proof of employment, such as pay slips or bank statements, to assess your ability to repay the loan.

- Income: Your income plays a crucial role in determining your loan eligibility. Capitec requires a minimum income threshold, which may vary depending on the loan amount.

The application process is moderately straightforward:

- Compile the necessary documents, including proof of identification, proof of address, and proof of income.

- Stop by your nearest Capitec branch or apply online through the Capitec website or mobile app.

- Fill out the loan application form, providing accurate and up-to-date information.

- Submit the required documents along with the application form.

- Capitec will assess your application, and if approved, you will receive the loan offer.

Tips for Approval and Responsible Borrowing

While Capitec aims to help blacklisted individuals, it is important to keep in mind that loan approval is not assured. Yet, there are steps you can take to enhance your chances:

Give Them Accurate Information

Ensure that all the data you provide on the application form is valid and up-to-date. Any inconsistencies or false information will bring about rejection.

Demonstrate Affordability

Capitec checks through your income and expenditures to ascertain if you can comfortably afford the loan repayments. Be ready to supply comprehensive details of your financial situation.

Improve Your Credit Score

Although Capitec gives loans to blacklisted individuals, it’s valuable to work on improving your credit score.

Timely payments, lessening outstanding debts, and avoiding new credit applications can positively influence your creditworthiness.

Pros and Cons of Loans for Blacklisted Borrowers

There are both pros and cons to assess when taking out a loan if you are blacklisted.

Some of the pros of taking out a loan include:

Access to cash

A loan can give you access to cash that you may not otherwise have. This can be useful if you need to cover an unexpected expense or make a significant purchase.

Improve your credit score

Making timely payments on your loan can help to enhance your credit score. This can make it effortless to obtain loans in the future.

Build your credit history

If you do not have a credit history, taking out a loan can help you to create one. This can make it easier to get loans in the future.

Some of the cons of taking out a loan if you are blacklisted include:

High interest rates

Blacklisted borrowers usually have to pay higher interest rates on loans. This is because lenders see them as a higher risk.

Short repayment terms

Loans for blacklisted borrowers usually have shorter repayment terms. This implies that you will have to pay off the loan more quickly, which can make it tougher to afford the monthly payments.

Hidden fees

There may be hidden fees connected with loans for blacklisted borrowers. These fees can sum up and make the loan more costly.

Frequently Asked Questions

How much can I borrow with a loan for blacklisted individuals at Capitec?

The loan amounts differ depending on the specific loan type and your individual circumstances. Capitec’s personal loans can range from R1,000 to R250,000.

What is the repayment term for loans for blacklisted individuals at Capitec?

The repayment terms can be made to fit your financial condition and the loan type you prefer. Capitec offers flexible repayment options.

What documents do I need to apply for a loan as a blacklisted individual at Capitec?

Generally, you will need to provide proof of identification, proof of address, proof of income, and any extra documents that Capitec may require for the specific loan application.

Can I apply for a loan for blacklisted individuals online?

Yes, Capitec offers online application alternatives through their website or mobile app, making it convenient to apply from the comfort of your home.

How long does it take to receive a loan decision from Capitec?

The loan decision timeline may differ, but Capitec strives to provide quick and efficient loan processing. You will be informed of the decision once your application has been assessed.

Are there any fees associated with loans for blacklisted individuals at Capitec?

Capitec charges fees and interest on their loan products. It is significant to review the terms and conditions, including the fees and interest rates, before applying for a loan.

Conclusion

Accessing a loan when you’re blacklisted can be challenging, but Capitec aims to make it easier. By offering personal loans and consolidation loans, Capitec guarantees that blacklisted individuals have alternatives to address their financial needs.

You only have to meet the eligibility criteria, gather the necessary documents, and provide accurate information during the application process.

Capitec aspires to empower individuals, giving them the opportunity to rebuild their financial stability.

Advertisements