Advertisements

Payday loans have been more than a “life safer” not just to salary earners but also to income earners– those who wait until the end of the month for an influx of cash.

Access Bank, since time immemorial, has been known for its financial services to people through different kinds of loans. Access Bank offers different loan types, and a Payday loan is one of them.

In this article, we shall explicitly discuss everything you need to know about this loan and then conclude by answering some of the frequently asked questions. Stay tuned and pay close attention.

Overview Of Access Bank Payday Loans

Access Bank Payday loan is one of the financial credits offered by Access Bank. The loans are disbursed immediately to the applicant’s bank account upon approval of the loan application.

Advertisements

This particular loan is explicitly targeted at salary earners and non-salary earners. This way, they can foot their bills, especially emergencies, without waiting for their subsequent cash flow, which comes by month end.

How Does Access Bank Payday Loans Work?

The process of applying for and obtaining a Payday loan from Access Bank is simple and hassle-free if you carefully read through this article.

As a salary earner, instead of waiting for month end before you can solve your pressing financial problems, you can opt for a Payday loan and repay when you receive your salary.

Access bank Payday loan is not an exception. However, you must be eligible for it. This entails passing the eligibility criteria risk known as Risk Acceptance Criteria (RAC).

The pressing question remains: What are those risk acceptance criteria? We shall answer this in the next section.

How To Be Eligible For An Access Bank Payday Loan

To be eligible and qualified for an Access Bank Payday loan, the following is required;

- You must not owe Access Bank or any other bank.

- You must have an active account with Access Bank or any other bank.

- You have to provide an active and registered phone number.

- Your NIN and BVN are not also left out. They help in verifying your identity.

- You must show evidence that you received payment in the previous month.

How To Apply For An Access Bank Payday Loan

One important thing to note about Access Bank Payday loans is that they are digital products. This means you can access them from your home– anytime and anywhere. The most important tool is your phone number with a strong internet connection.

There are various ways to apply for Access Bank Payday loans. They include:

- Using USSD Code: By simply dialing *901*11*1# or *426*11# and following the prompt, you can get instant Payday loans from Access Bank.

- WhatsApp Banking Platform: You can also apply for an Access Bank Payday loan through the Access Bank WhatsApp banking platform.

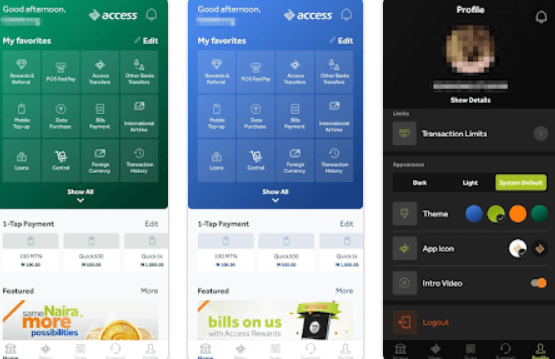

- Mobile App: Access Bank has a mobile app that shows the complete list of the loan schemes offered by Access Bank. You can download the app from the Apple Store or the Google Play Store and proceed to apply for your desired Payday loans.

Meanwhile, the Quickbucks app is also fit for this activity.

It is essential that we remind you that this particular loan takes about 24 hours to be approved and disbursed by Access Bank.

How Much Payday Loan Can I Borrow From Access Bank?

How much Payday loan you can access on Access Bank depends greatly on where you receive your salary.

- If you receive your salary with an Access Bank account, you can borrow up to 75% of your salary. This means you can not borrow the exact amount of your monthly income.

For example, someone who earns N100,000 in a month with an Access bank account is qualified for a Payday loan worth N75,000.

- And if you receive your salary through any other bank except Access Bank, you can only borrow 50% of your monthly income.

For example, if your salary is N100,000 and you receive it through other banks, not Access Bank, you can only apply for an N50,000 Access Bank Payday loan.

What Is Access Bank Payday Loan Interest Rate?

The Access Bank Payday loan interest rate is flat. It is 10% for Access bank users and 11% for non-users. However, this flat rate is dependent on the prevailing market conditions.

In addition, there is a 1% management fee and 0.3% credit life insurance.

How Do I Repay My Access Bank Payday Loan?

The repayment plan for Access Bank Payday loans is 30 days or your next payday.

However, repaying your Payday loan is automatic. Access Bank automatically deducts the money from your next salary before it arrives in your account.

Frequently Asked Questions

How do I qualify for an Access Bank Payday loan?

To qualify for an Access Bank Payday loan, you must ensure the following;

- Ensure that you do not have outstanding debts

- Ensure that your phone number is linked to your BVN and NIN

- Ensure that you received your salary in the previous month.

- Ensure that you have a bank account. An Access Bank account is preferable.

How does the Access Payday loan work?

Access bank Payday loans are simple to access. All you need is to scale through the Risk Acceptance Criteria (RAC) and proceed to borrow money without collateral or property papers and low-interest rates.

How long does it take to get Access Bank Payday loans?

It takes roughly 24 hours to apply, get approved, and disburse your funds to your bank account.

How do I repay my Access Bank Payday Loan?

Access bank automatically removes the money on your next Payday or after 30 days of tenure

How do I pre-liquidate my Access Bank Payday loan?

You can pre-liquidate your loans by calling +234 1 271 2005, emailing [email protected], or visiting any Access Bank branch to liquidate their loans.

Conclusion

Access Payday is one of the best loans for salary and non-salary earners without collateral. You need to be eligible for it before proceeding with your application. Meanwhile, receiving your salary through Access Bank is a bonus as it makes you eligible for 75% of your salary.

Save yourself from emergencies by seeking a Payday loan today. If you have any questions about this topic, we will gladly answer them in the comments box.

Advertisements